By Panos Xidonas

(In the acronym of MCDA I offer the ending word as analysis, rather than the conventional aid. This way I believe that MCDA reflects more accurately its broader scope towards its actual implementation in decision making)

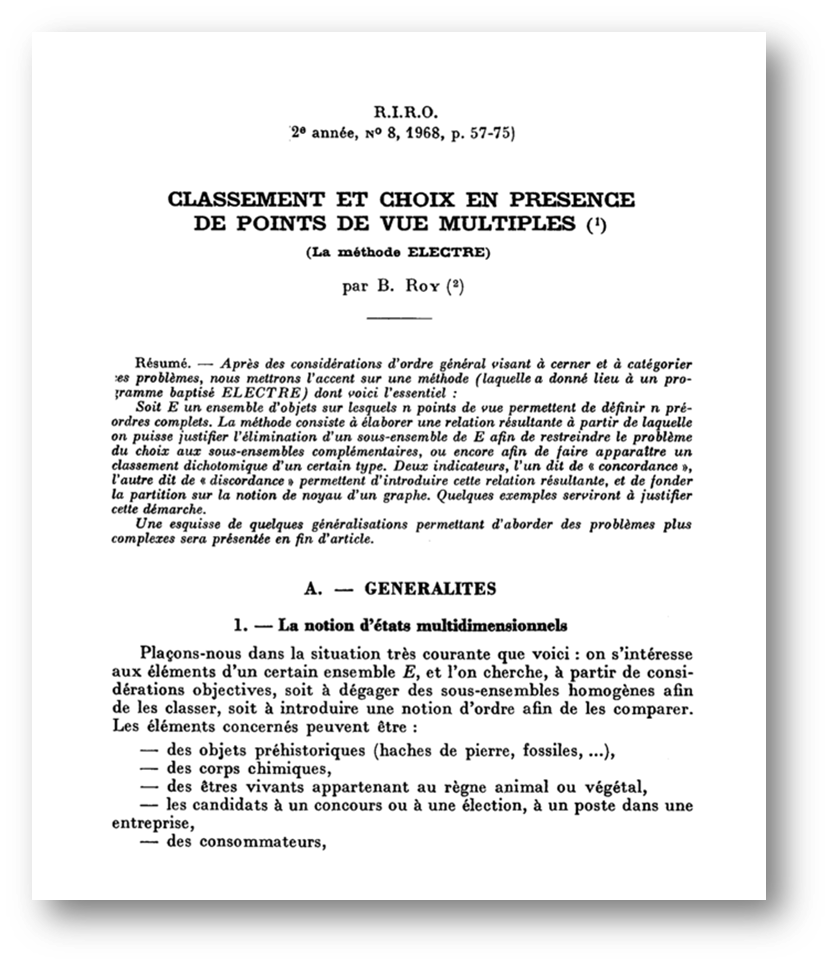

The seminal studies of Roy (1968) and Roy (1993) on the field of multicriteria decision analysis, a distinct filed of operational research/management science (OR/MS), were the ones that marked and characterized the underlying scientific imprint. These specific papers, along with the dominant books of Roy (1996) and Figueira et al. (2005), define the relevant state-of-the-art, although the field of decisions with multiple objectives relates to various other excellent treatments (Zeleny, 1982; Keeney & Raiffa, 1993). Overall, this particular scientific activity has received tremendous impact by the European OR school of thought, as this has been solidly founded by its father, Prof. Bernard ROY (1934-2017, Université Paris-Dauphine). In this post, I provide a first-aid bibliography on the cointegration of multicriteria decision aid (MCDA) with finance. My aim is to provide quick access for those interested, but not already in the area, so they know: (a) what the area is about, (b) what has been accomplished, (c) where the basic relevant studies everything can be found.

Figure 1. the seminal paper of Roy (1968) in the French journal RAIRO

The strong association of operational research with financial management goes back to the pioneer studies of Ashford et al. (1988) and Mulvey et al. (1997). Saaty et al. (1980) and Martel et al. (1988) were the first who offered real-world applications of multicriteria analysis in financial management, and more specifically in portfolio selection. Later, Spronk & Hallerbach (1997), Zopounidis (1999), Spronk et al. (2005) and Steuer et al. (2007), officially introduced and established the sound theoretical and practical framework of multicriteria financial decision making. After all, the uniquely comprehensive reviews of Steuer & Na (2003) and Aouni et al. (2018) on multicriteria analysis combined with finance, validate the extreme significance of the relevant association, between the two fields. But let’s start from the beginning.

Multicriteria analysis, often called MCDA by the European School and multiple criteria decision making (MCDM) by the American School, is a set of methods which allow the aggregation of several criteria, to evaluate a set of alternatives (Zopounidis, 1999). The development of MCDA is based on the simple finding that a single objective, goal, criterion, or point of view, is rarely used to make real-world decisions. The MCDA field is devoted to the development of appropriate methodologies that can be utilized to support the decision maker (DM) under circumstances where multiple, conflicting, and diversified decision factors must be considered simultaneously (Zopounidis & Doumpos, 2002).

The modeling framework of MCDA is well-suited to the complex nature of financial decision-making problems. Conventional optimization, statistical analysis and econometric approaches used within the finance context, are often based on the assumption that the considered problem is well-formulated against the reality involved, and they usually consider the existence of a single objective, that underlies the conducted analysis. In such a case the solution of financial problems is easy to obtain. However, the realistic modelling of financial problems is based on a different kind of logic. This is the multicriteria paradigm of Roy (1988), which takes into consideration the following elements: a) The existence of multiple criteria, b) The conflicting interaction between the criteria, c) The complex, subjective and ill-structured nature of the evaluation process, and d) The introduction of financial decision makers in the evaluation process. It is true that finance theory has adopted the principle of wealth maximization, as the single objective that drives decision making in the corporate world. Following this principle provides financial managers a specific target that guides the decision-making process. Furthermore, it is also easy to monitor and evaluate the results of the decisions taken, usually based on risk-adjusted performance measurement approaches.

However, this approach may be too simplistic to describe the daily operation of the business environment (Doumpos & Zopounidis, 2014). Some early criticism on the traditional financial decision-making rationale, comes from Bhaskar & McNamee (1983). As an example, regarding the capital budgeting routine, they pose a series of questions: a) In assessing investment proposals, do the decision makers have a single objective or multiple objectives? and b) If the decision makers do have multiple objectives, which are those and what is the priority structure of the objectives? In another similar study, Bhaskar (1979) notes that microeconomic theory has largely adopted a single-objective function, which is the principle of utility maximization for consumers and profit maximization for firms. The same author presents three categories of criticism regarding the use of this single-objective function principle for firms: a) There exist alternatives to the profit maximization approach, b) The profit maximization or any other equally simple hypothesis is too naive to explain alone, the complex process of decision making, and c) Real-world firms do not necessarily have proper information to enable them to maximize their profits.

Moreover, maximizing market value is another central paradigm in financial decision-making. There is a significant detail, however. Since financial markets are forward-looking, current market value originates from forthcoming cash flows, incorporating expectations regarding the future. Changes in these expectations will generate changes in value (Hallerbach & Spronk, 2002). A common share of stock, for example, derives its value from the dividends that are expected to be received in the future, and from its subsequent selling price. Likewise, the value of a bond depends on the coupon payments and final repayment of the nominal face value. As a result, the degree of uncertainty attached to the cash flows from an asset, calls for a risk analysis procedure. In turn, this transforms the underlying financial decision-making problem to a multicriteria one, due to the need for simultaneous assessment of additional objectives, such as various sources risk, e.g., market risk or interest-rate risk, liquidity, etc., beyond the typical expected return. Also, the neo-classical perspective of market efficiency, assumes ideal operation of financial markets. However, imperfections, such as information asymmetries, conflicting interests, and transactions costs, not only do exist, but also require a much richer description of the decision context.

Steuer & Na (2003) further enforce the argument that normative financial models hypothesize that a firm pursues the single objective of shareholder wealth maximization. However, a modern enterprise is a complex organization in which various stakeholders interact with one another, each with its own possible interpretation of wealth maximization, subject to concerns about risk, liquidity, social responsibility, environmental protection, employee welfare, and so forth. Thus, it may well be appropriate to pursue a multiple objective approach to many financial decision-making problems. After all, there is no doubt that financial decisions require the consideration of multiple factors, variables, and criteria, in a framework that needs to be flexible and customizable to the requirements of a particular situation (Doumpos & Zopounidis, 2014). Financial decision makers combine statistical estimates and forecasts, domain knowledge derived from the theory of finance, and constraints imposed by the external environment, with their own expertise, judgments, and decision-making policy.

In the above process, multiple perspectives, goals, and decision criteria are involved. As stressed, financial modeling is often based on the assumption that financial decisions are driven by a wealth maximization objective, but this single objective is often not well-defined, thus requiring a broader description through multiple sub-objectives or alternative factors. MCDA can be helpful in this context. It provides a wide range of analytic methodological tools for decision aiding under multiple conflicting criteria, and it is particularly useful for financial decision support. MCDA contributes at several levels of the financial decision-making process, covering both the problem structuring stages and algorithmic issues related to the construction and assessment of satisfactory solutions.

Consequently, an outmost research aim framing the underlying discussion, might be to achieve a holistic integration of financial theory and multicriteria decision technologies. Considering that the original approach seems to be necessary, but not sufficient to manage financial decision making efficiently, the MCDA framework may provide the sound methodological basis to resolve the inherent ill-structured nature of real-world financial problems.

References

Aouni, B., Doumpos, M., Peréz-Gladish, B., Steuer, R., 2018. On the increasing importance of multiple criteria decision aid methods for portfolio selection. Journal of the Operational Research Society, 69 (10), 1525-1542.

Ashford, R., Berry, R., Dyson, R., 1988. Operational research and financial management. European Journal of Operational Research, 36 (2), 143-152.

Bhaskar, K., 1979. A multiple objective approach to capital budgeting. Accounting & Business Research, Winter, 25-46.

Bhaskar, K., McNamee, P., 1983. Multiple objectives in accounting and finance. Journal of Business Finance & Accounting, 10 (4), 595-621.

Doumpos, M., Zopounidis, C., 2014. Multicriteria analysis in finance. Berlin-Heidelberg: Springer.

Figueira, J., Greco, S., Ehrgott, M., 2005. Multiple Criteria Decision Analysis: State of the Art Surveys. Springer Science, Boston.

Keeney, R., Raiffa, H., 1993. Decisions with multiple objectives: Preferences and value trade-offs. Cambridge: Cambridge University Press.

Martel, J.M., Khoury, N.T., Bergeron, M., 1988. An application of a multicriteria approach to portfolio comparisons. Journal of the Operational Research Society, 39 (7), 617–628.

Mulvey, J., Rosenbaum, D., Shetty, B., 1997. Strategic financial risk management and operations research. European Journal of Operational Research, 97 (1), 1-16.

Hallerbach, W.G., Spronk, J., 2002. The relevance of MCDM for financial decisions. Journal of Multi-Criteria Decision Analysis, 11 (4-5), 187–195.

Roy, B., 1968. Classement et choix en presence de points de vue multiples (la methode ELECTRE). Revue Informatique et Recherche Operationnelle 8, 57-75.

Roy, B., 1988. Des criteres multiples en recherche operationnelle: Pourquoi? In: Rand, GK. (Ed.), Operational Research ’87, Elsevier Science Publishers, North Holland, Amsterdam, 829-842.

Roy, B., 1993. Decision science or decision-aid science? European Journal of Operational Research, 66 (2), 184-203.

Roy, B., 1996. Multicriteria methodology for decision aiding. Springer Science & Business Media, New York.

Saaty, T., Rogers, P., Pell, R., 1980. Portfolio selection through hierarchies. Journal of Portfolio Management, 6 (3), 16–21.

Spronk, J., Hallerbach, W., 1997. Financial modelling: where to go? With an illustration for portfolio management. European Journal of Operational Research, 99 (1), 113–127.

Spronk, J., Steuer, R., Zopounidis, C., 2005. Multicriteria decision analysis/aid in finance. In: Figuiera, J., Greco, S., Ehrgott, M. (eds.), Multiple Criteria Decision Analysis: State of the Art Surveys, Springer Science, pp. 799-857.

Steuer, R., Na, P., 2003. Multiple criteria decision making combined with finance: A categorized bibliography. European Journal of Operational Research 150 (3), 496–515.

Steuer, R.., Qi, Y., Hirschberger, M., 2007. Suitable portfolio investors, non-dominated frontier sensitivity, and the effect on standard portfolio selection. Annals of Operations Research, 152 (1), 297-317.

Zeleny, M., 1982. Multiple criteria decision making. New York: McGraw-Hill.

Zopounidis, C., 1999. Multicriteria decision aid in financial management. European Journal of Operational Research, 119 (2), 404–415.

Zopounidis, C., Doumpos, M., 2002. Multicriteria decision aid in financial decision making: Methodologies and literature review. Journal of Multi-criteria Decision Analysis 11 (4-5), 167-186.